REPUTATION STUDY:

INDIAN BANKING INDUSTRY

Introduction

The world’s 5th largest economy and still growing rapidly, the Indian economy is one of the most watched ones currently. A robust banking industry is a must to continue or rather strengthen this pace of growth. Be it infrastructure financing, technology upgradation, skill development, lifestyle improvement, or international trade, the banking industry influences every aspect of the social and business fabric of the economy.

While the banking industry has responded equally strongly to its growing significance, there is always room for more. Additionally, there are enough narratives in the public domain that may not have painted the correct picture, thereby colouring perceptions and hence the banking industry’s reputation.

The future economic performance of companies and the industry as a whole can be better predicted using non-financial metrics like reputation. It is the gap between a firm’s economic performance and value-driving operations. In addition, they are more directly related to the corporate and business-level strategies of the companies. Business value is primarily driven by reputation. The need to preserve reputation refrains banks from opportunistic behaviour that will result in short-term advantages at the cost of losing long-term stability, corporate citizenship, and future income.

Eminence, a Strategy Consulting, company focused on reputation, undertook this extensive study of the banking industry to understand the industry’s stakeholder (clients, regulators, employees, partners, and more) perceptions and arrive at a holistic reputation score.

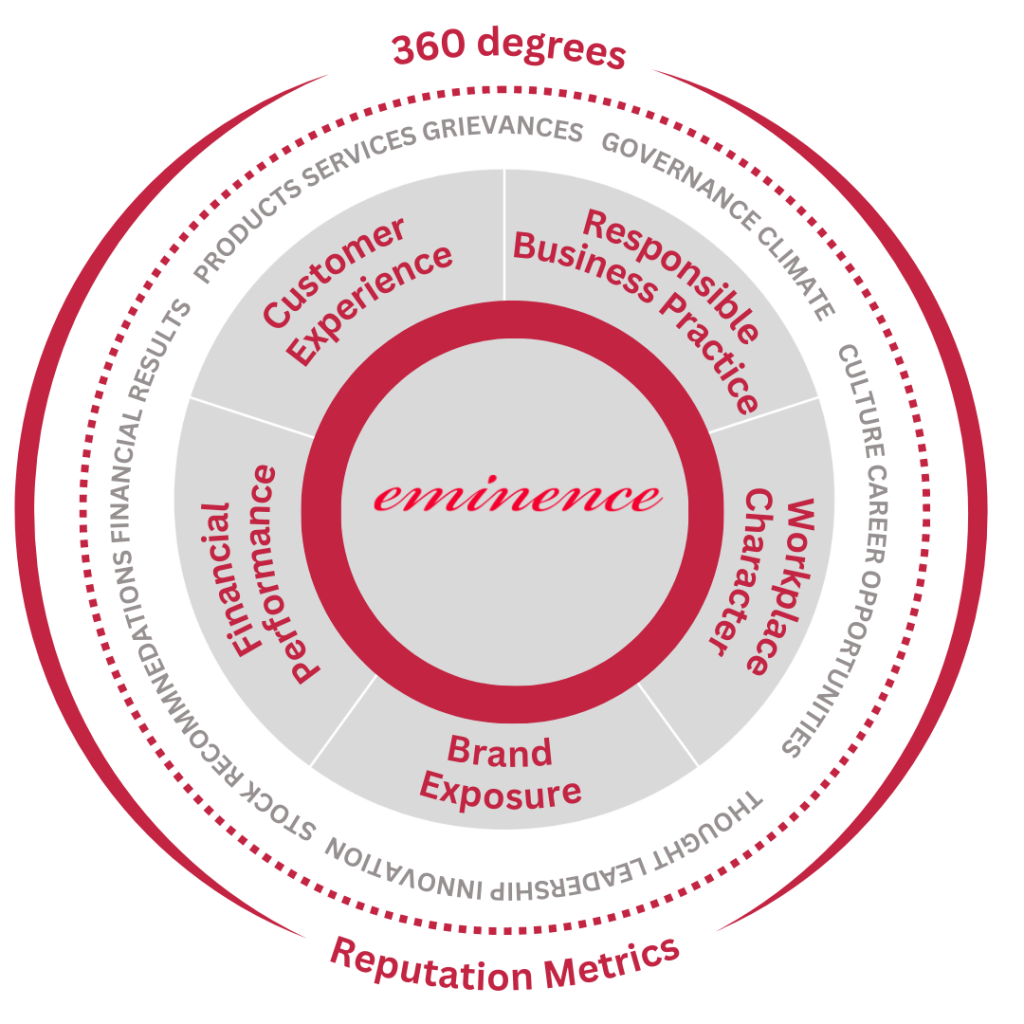

Reputation is an overarching concept encompassing all the facets of a business from the little things that matter to major business decisions; however, no specific measurement criterion or tool is available that holistically measures an organization’s reputation and provides actionable insights. Thus, Eminence Strategy Consulting developed a comprehensive concept of the “Reputation Score.”

Reputation Score is a weighted average of five parameters arrived at through an extensive survey of corporate leaders. Companies’ reputation is based on the stakeholder’s perceptions, right from the customers they serve, to the workforce they employ, shareholders who invest in the organization’s vision, the perception about the corporate governance practices, and the positive impact the organization has on society as a whole.

This report focuses on the reputation drivers of the banking industry in the 12 months of 2022. The analysis shows that the overall reputation score of the banking industry from January to December 2022 is 16.2, representing a poor score, with the need to focus on human-centric areas. The biggest positive contributor to the score was Brand Exposure and Responsible Business Practices, while the score took a negative hit through Customer Experience and Workplace Character drivers.

Limited technology upgrades, delayed redressal of customer grievances, and inadequate career growth opportunities emerged as top negative reputation drivers. The banking industry scored brownie points for its ESG practices, effective communication of its products and services, and thought leadership. The weighted score of negative conversations significantly affected the overall score, inspite of the banking industry performing well in other areas of reputation.

Going forward the industry must focus on robust feedback mechanisms, repositioning from a service provider to a solution partner, creating a conducive work environment, and making customers well-informed about the changes taking place in the banking operations w.r.t. technological updates and regulatory framework among others.

We hope you will enjoy reading this report and we look forward to receiving your valuable feedback.

Eminence Reputation Score: A comprehensive model capturing multiple reputation dynamics

Banking Industry Coverage

Public Sector banks, Top Private banks, Foreign banks and Small banks

January – December, 2022

Data Sources

Social Media Conversations I Employee Reviews I Customer Reviews I Media Coverage

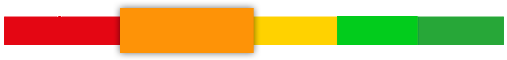

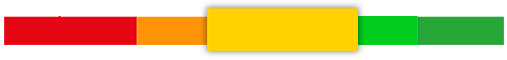

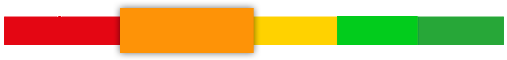

Scoring Scale

POOR

(<0-20)

Moderate

(21-40)

Average

(41-60)

Good

(61-80)

Excellent

(81-100)

Our analysis shows that the overall reputation score of the banking industry from

January to December 2022 is 16.2, representing a poor score with significant upside potential.

Each driver has a defined weightage as per the Eminence Reputation score model

The Reputation Score is based on following drivers

Reputation drivers arranged in descending order of the weightage assigned to each

No Data Found

-19

Customer Experience

No Data Found

34

Responsible Business Practices

No Data Found

47

Brand Exposure

No Data Found

8

Workplace Character

No Data Found

30

Financial Performance

Click on each driver graph for insights

Attributes driving the Positive Reputation Score

Significant role in the overall economy & market, thought leadership, noteworthy ESG practices

Attributes driving the Negative Reputation Score

Customer grievances, employee observations

Customer Experience

Mis-selling, misbehavior of customer service executives, issues with online banking, and hidden charges levied by banks, resulted in a low score for the category

Customer experience is the key competitive differentiator in any industry as it results in loyal customer base, higher rates of recommendation, bigger wallet share, and opportunities to up-sell or cross-sell products and services. The study indicates a poor score for the banking industry. The sheer volume, demographic diversity and scale makes broad-based customer delight a tough ask. Top that with diverse requirements of institutional and retail customer expectations.

Score

Most Prominent Topics

-19

(POOR)

No Data Found

- Given the sensitivity of COVID -19, banks were mindful of customer concerns and hence were swift to convey changes in bank rates.

- There were prompt responses to customer queries.

- There was proactive communication by the banks on new facilities.

Digital transformations on the back of demonetisation followed by COVID-19 have brought about a sea change in the overall banking experience. Upgrade in quality of services, prompt response to customer queries, and proactive communication to regulatory developments added to the positive score. On the institutional customer front, quick adoption of Government guidelines and regulations, prompt response to increasing working capital needs, focus on empowering the MSMEs, digital-led innovation and focus on sustainability initiatives were particularly applauded.

Persistent calls from call centres to sell credit cards and insurance are not appreciated.

Delay in processing customer requests was the second most highlighted concern.

Customers dislike the hidden charges levied on their cards.

Mis-selling, and frauds were a deterrent inspite of the best efforts of banks to create a secured banking experience.

While banks went all out to showcase their digital prowess, customers faced issues with the applications, ranging from downtime to service requests not closed on time, etc.

Complaints about hidden charges on cards and services, inappropriate behaviour of customer service executives, and delays in response to queries/concerns, led to a negative customer experience. Numerous calls for selling credit cards, loans, and other banking products irked the customers, adding to the service quality concerns. Customers faced issues with the applications, ranging from high downtime to service requests not closed on time. Mis-selling and frauds added to the list of grievances, lending a negative tone of the overall customer experience of the banking industry.

Responsible Business Practices

Integrating the Best ESG practices in business operations led to a positive impact on the industry

Stakeholders across the board have become conscious of associating with corporates that do their business responsibly. Even the role of the Indian banking sector has become more significant to manage risks and maintain sustainable development. The thrust in the environmental initiatives of the banks positioned them as Responsible Corporate Citizens.

Score

Most Prominent Topics

34

(MODERATE)

No Data Found

Focus on skill development, women empowerment, education, covid support, Swachh Bharat, environment protection and sanitation, animal welfare, sports and athletes, and health care, strengthened the overall RBP score for the category.

Banks focused on Diversity & Inclusion, especially with a conscious representation on the board of directors and the leadership team.

Committed to financial inclusion of the unserved and underserved segments, and driven towards fostering financial discipline in India, the banking sector focused on financial literacy programs through digital modes. More than 70% of banks conducted financial literacy camps at their rural branches.

Most banks in India have instituted environmental, social, and corporate governance (ESG) policies focusing on short–term goals and green bond frameworks and have committed resources to finance green projects.

With a commitment to reducing its carbon footprints, the Indian banking industry has started reducing the use of paper and single-use plastics. The industry is also taking some other initiatives in the form of campaigns such as go green, engine-off, and awareness about climate change among others. Focus on skill development, women empowerment, education, covid support, Swachh Bharat, environment protection and sanitation, animal welfare, sports, and athletes, health care strengthened the overall score for the category.

Thrust on Gender Diversity and Inclusion, especially with a conscious representation of females on the board of directors and the leadership team added to the positive score.

- While foreign banks have promised to phase out financing of coal-powered plants and mining by 2040, a report by think-tank Climate Risk Horizons stated that PSU banks lag behind the private sector.

- Frauds within banks and board members plagued the banking industry for some time now.

Various studies presented a concern highlighting that Indian banks are unprepared to respond to the climate crisis, particularly when it comes to incorporating climate-related financial risks into routine decision-making and strategizing. Data released by RBI indicating the high number of frauds reported by the banks in 2021-22, added to the negative recall. Due to its linkages with all other industries, the banking industry got pulled into Governance related controversies.

Brand Exposure

Views on Banking leaders were given importance in the discussions w.r.t country’s economic growth. Consistent messaging of their efforts through a unified approach of traditional and digital media channels drove recall and positive perception

The banking industry produces high decibels of media exposure through its extensive marketing and communication strategies. Focus on digitising the banking experience continues to be a priority for banks, but these endeavors also have their share of concerns w.r.t to execution and application for the consumers.

Score

Most Prominent Topics

47

(AVERAGE)

No Data Found

The first two quarters of 2022, saw aggressive communication from all players, esp. the leading private banks for Credit Cards and Fixed Deposit schemes.

Launch of the industry’s first customizable Credit Cards, with a majority of users in Tier 2 and Tier 3 cities, and an increase in Fixed Deposits rates for Senior Citizens were the most promoted offerings.

Banks launched products with numerous tie-ups with brands and e-commerce platforms, especially with one of the larger foreign banks launching its first credit card in India. Private banks fortifying their place in rural India as well by reaching out to villages further amplified the score.

With mergers and acquisitions in the sector, the focus is to increase the banking product portfolio and ability to cross-sell.

The leaders have a strong influence on the economic policies of the country which is apparent through the thought leadership established by the CEOs across public & private sector banks.

Focus on bolstering India’s digital ecosystem, digital security, cardless cash withdrawal, Mobile ATM, API banking portal, voice banking, video KYC, and collaboration with RBI on blockchain blockchain-based project, were few of many initiatives by the sector to enhance its digital infrastructure.

The thought leadership demonstrated by most bank CEOs with their views on global and domestic economic and corporate developments contributed highly to the intellectual perception of the banks.

Right product strategy includes adding value to the financial need of the customers. The Banking industry has been relentlessly launching innovative products with evolving customer requirements. For instance, the launch of the industry’s first customizable Credit Card, with a majority of users in Tier 2 and Tier 3 cities was one of the most talked about launches. The increase in Fixed Deposits rates for Senior Citizens was extensively covered by the media. Private banks fortifying their place in rural India as well by reaching out to villages further amplified the score.

Digital transformation has played a vital role in changing the banking industry’s image and acting as an ambassador for Digital India. Focus on bolstering India’s digital ecosystem, digital security, cardless cash withdrawal, Mobile ATM, API banking portal, voice banking, video KYC, and collaboration with RBI on blockchain-based projects were a few initiatives to enhance the digital infrastructure. Top management appointments and partnerships further increased the interest in the banking category.

- News about malpractices on the boards of some of the leading private banks led to negative media attention.

News about malpractices on the boards of some of the leading private banks led to negative conversations. Controversial news about discrepancies in financial dealings and frauds by CEOs & CXOs of leading banks raised trust issues for the category.

Workplace Character

Long working hours and the absence of work-life balance overshadowed the efforts of the banks towards employee satisfaction

The banking industry is one of the top employment providers in India. Digitisation has changed the face of banking in India, leading to a need for digital evangelists rather than just banking professionals. This has led to a skill gap within the banking industry. The efforts by banks to upgrade their workforce are growing at a slower pace than the customer demand, thereby creating a highly challenging work culture. Efforts by banks have been commendable, but a lot is yet to be accomplished.

Score

Most Prominent Topics

8

(POOR)

No Data Found

- Banks give immense importance to HR programs and employee benefits.

- Training programs for new recruits and sponsored programs in association with universities were given high importance to create a positive workplace experience.

- On job sites, employees gave positive reviews about work culture, esp in a few private sector banks.

- Banks are warming up to diversity and inclusion, with special benefits to the LGBTQ community and minor communities.

Banks gave immense importance to HR programs and employee benefits. The training programs for new recruits and sponsored programs conducted by the banks, in association with universities were given high importance to create a positive workplace experience. This was also reflected on job sites, where employees gave positive reviews about work culture, especially in a few private sector banks.

The Diversity and Inclusion quotient has found its way in the banking category as well. Banks are warming up to DEI, with special benefits to the LGBTQ community and minor communities. Other employee rights, especially for women at workplace came to light when one of the leading PSB banks had to recall its policy toward pregnant women and make amendments.

Long working hours and the absence of a work-life balance has been the top grievance of the bankers.

Limited career opportunities in banks (esp. the bigger banks), and favouritism, were the negative comments made by employees on job sites.

Lack of proper training and learning opportunities were also highlighted as concerns.

Negative responses on various public platforms about the work culture, long working hours and the absence of a work-life balance topped the list of employee feedback. Despite the efforts of banks to provide better career progression, training and development, there seems to be a disparity in the talent and training policies extended to executive roles compared to the workforce in the field. There were other concerns, such as aggressive targets, and a highly competitive work environment led to employee dissatisfaction.

Financial Performance

Indian Banking Industry has shown business growth amid challenging economic environment

The Indian banking sector has outperformed the markets, despite inflationary pressures, economic slowdown and market volatility. The street has recommended a ‘buy’ or ‘hold’ for most banks on the back of improved asset quality and robust business growth. The focus on financial inclusion has made this one of the strongest sectors. The gross and net NPAs of the banks stood at 6% and 1.7%, respectively, as on March 31, 2022, the lowest since 2016. The deposits grew at a seven-year CAGR of 8.70%, despite the COVID impact.

However, not all banks could cope with the regulatory changes post-COVID-19 and the unfavorable geopolitical scenario, which was reflected in their dismal performance.

At the overall industry level, good financial results and stock market rallies have regained investors’ confidence in the sector.

Score

Most Prominent Topics

30

(MODERATE)

No Data Found

- Banks give immense importance to HR programs and employee benefits.

- Training programs for new recruits and sponsored programs in association with universities were given high importance to create a positive workplace experience.

- On job sites, employees gave positive reviews about work culture, esp in a few private sector banks.

- Banks are warming up to diversity and inclusion, with special benefits to the LGBTQ community and minor communities.

- The Indian banking industry has shown a strong operating performance and robust business growth while asset quality has been improved amid a challenging economic environment.

- Despite the inflationary pressures and the COVID-19 uncertainty, the banking category stocks maintained a positive rally at the share markets.

Long working hours and the absence of a work-life balance has been the top grievance of the bankers.

Limited career opportunities in banks (esp. the bigger banks), and favouritism, were the negative comments made by employees on job sites.

Lack of proper training and learning opportunities were also highlighted as concerns.

Long working hours and the absence of a work-life balance has been the top grievance of the bankers.

Limited career opportunities in banks (esp. the bigger banks), and favouritism, were the negative comments made by employees on job sites.

Lack of proper training and learning opportunities were also highlighted as concerns.

Potential Reputation Risks

The aspiration of Digital India has been spearheaded by the Banking industry. Yet when it comes to user experience, esp. w.r.t senior citizens and the rural population, there seems to be a lack of proper training on the banking platforms and online tools, also leading to mis-selling and fraud. Insufficient digital literacy programs can hamper the imagery of the banking industry in times to come.

Increasing awareness programs to upgrade overall digital literacy could help in bridging this gap. Banks working more closely with telecom service providers can complement both sectors, with customers being the end beneficiaries.

Given the importance and size of the banking industry, it remains one of the biggest recruiters in the country. While the efforts in acquiring the right talent or upskilling them assume top priority for the banks, it may take away the focus from nurturing the existing talent. Furthermore, banks’ efforts towards employees hit a roadblock with aggressive targets and long working hours.

Creating a conducive work environment is essential. Employees are the biggest brand ambassadors when given a positive experience. While a lot has been done by the banks in terms of workplace best practices, yet negative reviews on public platforms, esp. from the on-ground/sales executives, reflect a high level of discontent amongst the personnel.

Negative reviews from retail customers of banks have been significant across the board, especially on social media platforms. Be it mis-selling, overselling or snags in digital banking platforms, customer angst is high. Corporates too have concerns with relationship managers’ constant urge to meet targets, deepen the wallet share and expand the portfolio. Similarly, as evident in various news reports, there is increasing pressure on risk teams to approve the deals. While banks are investing heavily in customer service teams or strengthening customer orientation, yet the gap appears too wide.

Shifting gears from being a service provider to a solutions partner can prove beneficial for all stakeholders involved. In the financial services industry emotions weigh higher than functions, most clients operate on “trust” with service providers. And that differentiator must be understood and leveraged in customer engagement.

Banking is a highly regulated industry and there have been drastic changes in the regulatory framework of the Indian banking industry over the years. For laypersons (retail or corporate client) to keep a track of the same and understand the implications on their own is impossible. Though banks communicate these developments from time to time to the customers, the technical language of these communications adds to the levels of confusion and mistrust.

In this always-on and heavy information-flow digital world, simple and proactive communication is a necessity. While customer service centres of banks are widely accessible, the transfer of information is more reactive and complex. Simplifying the complicated technicalities and conveying the implications on the end-user in elementary terms can enhance trust and improve perceptions.

Worldwide, including in India, the banking industry is one of the most highly reported industries by the media fraternity. Given its impact on the overall economy and the lives of common people, this emphasis is justified too. Thus, news on leaders’ misconduct, malpractices, and corporate governance compromise etc. immediately hit the headline thereby driving negative perceptions.

Tighter regulations and increased due diligence from banks are obvious solutions to overcome these concerns. Additionally, banks have to step up their communication practices through more frequent and widespread messaging through effective storytelling, case studies & client testimonials. This will promote positive stories to the larger mass and create a shift in perception, for both retail & institutional customers.

Recommendations

Banks are launching new products, while customers are still grappling with the existing products. Closing the service gap is essential for a smoother customer experience. Customers are putting their grievances on public platforms, that reflect a disparity in the flawless user experience committed by the banks. A focus on educating customers on better usage of digital platforms can mitigate the concerns.

The buzz around sustainable practices has increased, and the narrative is mainly steered by foreign banks. Private banks and more importantly, PSBs should increase their focus on ESG in order to remain relevant to the stakeholders, especially the environment conscious future customers.

Employees are the biggest brand ambassadors and turn into loyal customers when given a positive experience. While a lot has been done by the banks in terms of workplace best practices, negative reviews on public platforms reflect a high level of discontent amongst the personnel. This needs to be addressed as a priority for banks to continue being among the preferred sector by the current and potential workforce.

Concept & Methodology

Reputation is an overarching concept encompassing all the facets of a business from the little things that matter to major business decisions; however, there are no specific measurement criterion or tools available that presents a holistic picture of an organization’s reputation or provides a consolidated rating. With this background, Eminence developed the concept of “Reputation Score” as a composite score to measure an organization’s standing based on publicly available data and credible industry sources of information.

This one of its first-of-its-kind, holistic Reputation Measurement Score is based on the globally accepted parameters. The dashboard offers a complete view of an organization’s reputation across its stakeholders. Since a multitude of factors influences corporate reputation, an exploratory study was conducted across CEOs and CXOs to understand the most impacting elements of reputation. Internal focus group discussions (FGD) were conducted with the objective to identify a comprehensive list of factors affecting corporate reputation. The identified reputation drivers, hence, are a result of well-researched ideas and feedback from this stakeholder group and secondary research sources.

The banks selected for the study were based on parameters such as the type of banks (Public Sector, Indian Private Banks, Foreign Banks, Small banks), market share, size of the bank, and listing on the stock exchange. The sample is a combination of public sector banks, leading private banks, foreign banks & small banks.

The study takes into account :

50+

Data Variables

10,000+

Business responsible conversations across news & social media

1,000+

Customer & employee voices

The score is arrived at based on scientifically designed weights and statistical algorithms, corroborated by research experts.

Team Eminence

Extensive experience in Branding, Communications, Brand Research, and Data Analytics. Experienced professionals, having worked in business categories like Banking and Financial Services, IT, FMCG, Entertainment, Automobiles, Telecom, Manufacturing, Credit Ratings, etc. A diverse mix from the fields of Journalism, Economics, Brand Research, Media Measurement, forms a strong force of individual and collective knowledge base for our clients.

Mitu Samar, Founder & CEO of Eminence, is a seasoned reputation consultant with two decades of experience. After having worked with well-known companies across BFSI, Credit Ratings & Logistics, she founded Eminence Strategy Consulting (www.eminencestrategy.com), thus facilitating organizations and individuals in building, establishing, and protecting their reputation through stakeholder engagement. She serves as an independent director on the boards of the Times Internet Limited and Aegon Life Insurance.